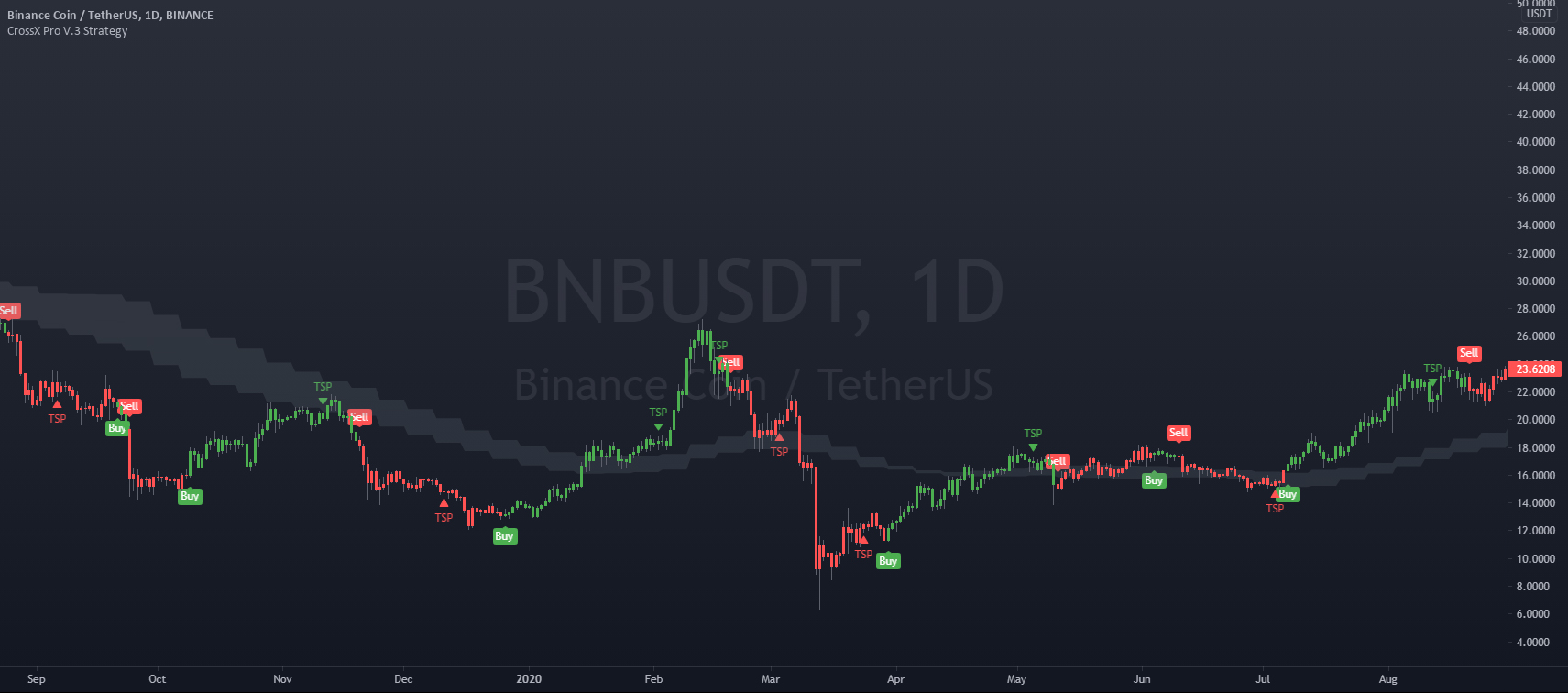

Cross-X indicator

Cross-X is a trend following indicator that deliver signals to traders on the TradingView platform. It is easy to use, smooth, highly profitable, non repaint and excellent performance. Click here to see the excellent performance of Cross-X indicator.

Cross-X is a trend following system

Trend trading or trend following is an outstanding way to profit from large moves in the markets without spending a lot of time in front of the computer. Trend traders identify trends and find low risk entry points from which they hold their position until the trend reverses. This style works in all market and can be highly profitable given sufficient diversification and given strong risk control. Trend trading is usually considered a mid to long-term trading strategy. CrossX indicator is designed to help you identify trends as early as possible and exit the market before they reverse. Both the closing price, momentum, volume, volatility, strength of a trend, ATR and PSAR with some additional logic provide a wealth of information that can be used to identify the ebb and flow of the trend. CrossX indicator is which will identify a trend and send the signals to traders after that traders will ride the trend from start to finish, ignoring day-to-day fluctuations.